I want to

We have got everything you need financially.

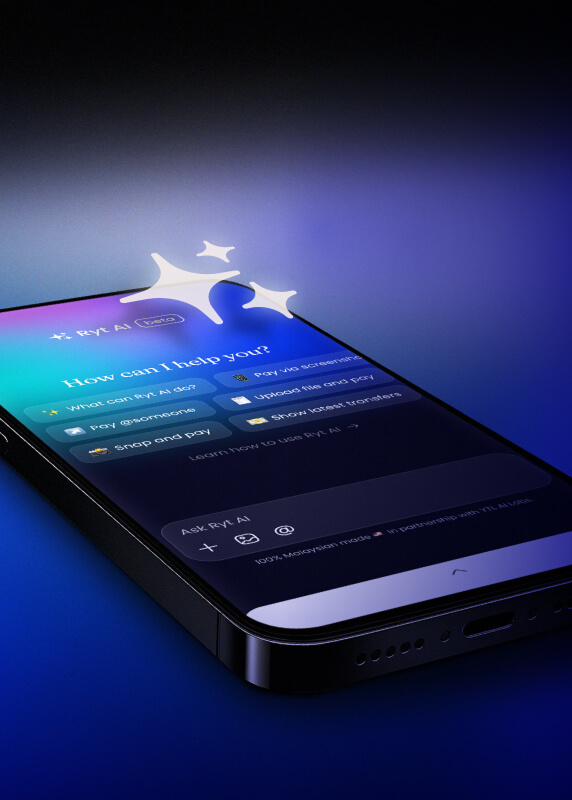

The World’s First

AI-Powered Bank*

Say hello to Ryt AI

Simplifying banking tasks, providing real-time insights, and offering 24/7 support.

*For payments. Terms and conditions apply.

A member of PIDM. Protected by PIDM up to RM250,000 for each depositor.