Unlimited 1.2% cashback overseas

Earn on every in-store overseas spend, no cap.

Your sleek, bold card for seamless spending, smarter savings, and total control.

No annual fees, no hidden charges. Every swipe comes with rewards, savings, and more freedom.

Earn on every in-store overseas spend, no cap.

For the first 2 withdrawals of the calendar month.

Pay exactly what you see, with no hidden FX charges.

At a curated list of premium dining spots. View full participating list here.

Click here to view the full terms and conditions.

Smarter tools that give you full control, real-time visibility,

and peace of mind, every time you spend.

Shop securely online anytime.

No waiting, no hassle.

Get real time alerts with every notifications.

Know exactly where your money goes.

Stay in control of your budget, your way.

Lock or unlock your card anytime, with a single tap.

Personalise your settings.

You’re always in charge.

Spend safer online.

Your physical card is for daily use. Your virtual card is for online spending - secure, instant, and always in your control.

One app. Two cards.

Zero worries.

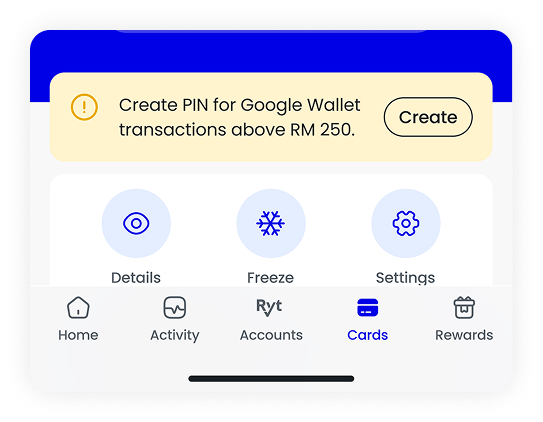

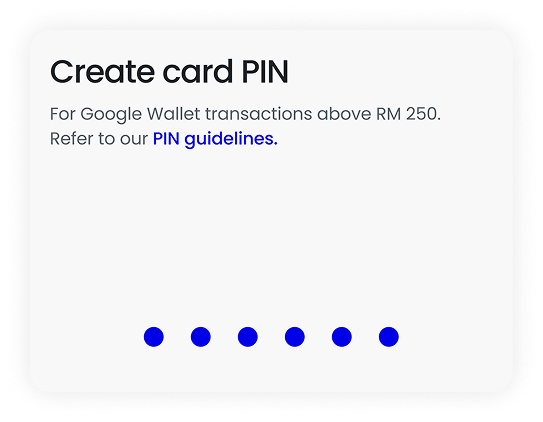

Your Ryt Card is now available in Google Wallet. Enjoy faster, safer, and more convenient payments wherever contactless payment is accepted. Simply add your card and start tapping today.

Access your Ryt Bank app

Tap Create PIN for Google Wallet transactions above RM250

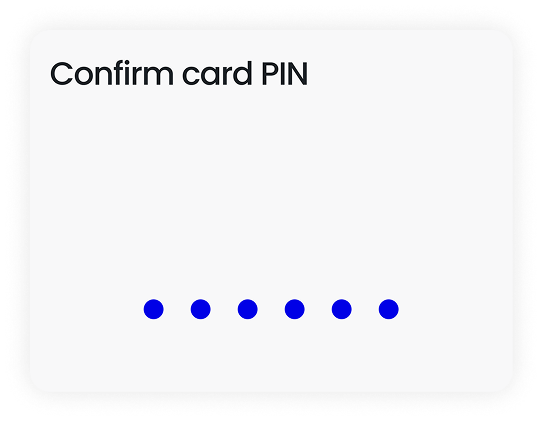

Enter your preferred PIN and confirm